Photographer: Charly Triballeau/AFP/Getty Images

Asian stocks fell with U.S. futures Thursday after an overnight surge in sovereign bond yields once more dragged down shares on Wall Street. Treasuries held those losses and the dollar ticked higher.

The technology sector led the worst drop in MSCI Inc.’s Asia-Pacific gauge this week as shares slid from China to Australia. S&P 500 and Nasdaq 100 futures dipped after a slump in the indexes took the tech-heavy gauge to a two-month low. Declines in Apple Inc. and Amazon.com Inc. outweighed gains in banks and energy producers amid a global rotation to value stocks.

Australian bonds tumbled after benchmark Treasury yields earlier approached 1.5%. A market gauge of inflation expectations over the next five years hit its highest level since 2008. Traders also assessed data pointing to an uneven economic recovery from the depths of the pandemic.

The rise in inflation expectations and long-term borrowing costs is stoking concern that equity markets may wobble after a prolonged rally. Investors are trying to assess central banks’ appetite to buy more longer-dated bonds to keep financial conditions loose. The focus turns to Federal Reserve Chairman Jerome Powell’s upcoming comments, after Chicago Fed President Charles Evans said the recent climb in yields reflected economic optimism.

“Inflation is a concern; there is a lot of money sloshing around the system and it makes sense to have some sort of a correction right now,” said Shana Sissel, Spotlight Asset Group chief investment officer. “And bond yields going up is the market’s implicit way of tightening since the Fed has made it clear they don’t have the intention of doing so.”

Read: U.S. Inflation Expectations Hit Decade High as Yields Resurge

Democratic leaders in the Senate are working to consolidate support for the $1.9 trillion stimulus bill, which is expected to bolster economic expansion. The U.S. economy expanded modestly in the first two months of the year and vaccinations are supporting business optimism, according to the Federal Reserve’s Beige Book.

Real estate, finance and energy shares outperformed in Asia on Thursday amid the shift to value segments. Oil was above $61 a barrel as investors waited for the result of a critical OPEC+ policy meeting later Thursday. Bitcoin retained recent gains to trade around $50,000.

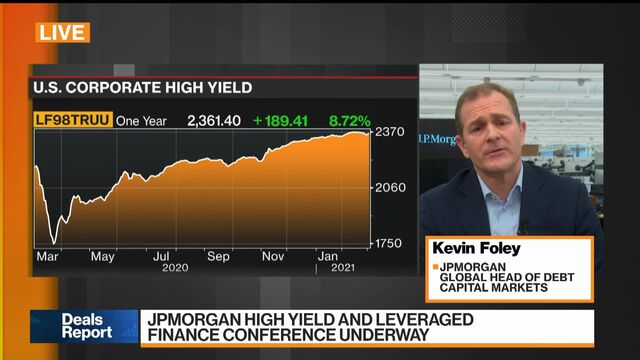

Kevin Foley, JPMorgan global head of debt capital markets, talks about liquidity in markets and how the pandemic is impacting credit and m&a activity. s. He speaks to Bloomberg’s Ed Hammond. (

Source: Bloomberg)

Some key events to watch this week:

- OPEC+ meeting on output Thursday.

- U.S. factory orders, initial jobless claims and durable goods orders are due Thursday.

- Federal Reserve Chairman Jerome Powell speaks Thursday.

- The February U.S. employment report on Friday will provide an update on the speed and direction of the nation’s labor market recovery.

These are some of the moves in markets:

Stocks

- S&P 500 futures fell 0.4% as of 12:12 p.m. in Tokyo. The S&P 500 fell 1.3%. The Nasdaq 100 lost 2.9%.

- Japan’s Topix index fell 1.3%.

- Australia’s S&P/ASX 200 index fell 1%.

- South Korea’s Kospi index slid 1.5%.

- Hong Kong’s Hang Seng index lost 2.3%.

- Shanghai Composite was down 1.7%.

Currencies

- The yen traded at 107.06 per dollar.

- The offshore yuan was at 6.4763 per dollar.

- The Bloomberg Dollar Spot Index rose less than 0.1%.

- The euro traded at $1.2054, down 0.1%.

Bonds

- The yield on 10-year Treasuries was steady at 1.48% after rising nine basis points.

- Australia’s 10-year bond yield rose 11 basis points to 1.79%.

Commodities

- West Texas Intermediate crude added 0.3% to $61.44 a barrel.

- Gold was little changed at about $1,711 an ounce after sliding.

— With assistance by Rita Nazareth, and Claire Ballentine

https://ift.tt/3uQOJFZ

Business

Bagikan Berita Ini

0 Response to "Stock Market Today: Dow, S&P Live Updates for Mar. 4, 2021 - Bloomberg"

Post a Comment